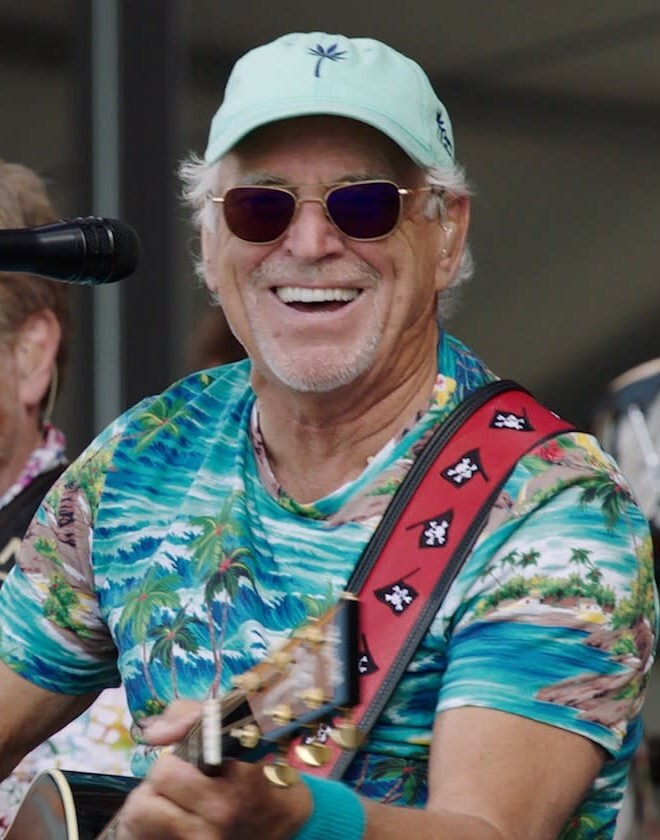

Picture a tiki bar at sunset, the strum of a steel drum, and a frosty margarita sweating in your hand. Jimmy Buffett, the late pirate poet, spent his life crafting songs urging us to slow down and live like every day is a beach party. His music was magic, but his estate plan? Well, that’s a sour note.

Jimmy Buffett died in 2023 at age 76 from a rare, aggressive form of skin cancer that each year strikes only about 2,500 Americans. He left behind more than just Cheeseburgers in Paradise. He created an estate, with an estimated value of $275 million, for his wife of 46 years, Jane.

But shortly after his death, his plan veered off-key. Buffett named his wife as co-trustee alongside his accountant and business manager, Rick. Clearly, the singer-songwriter envisioned a harmonious duet. Instead, the pair of Rick and Jane are clashing furiously.

Rick apparently thought $2 million a year was a generous allotment for Jane to continue living the toes-in-the-sand lifestyle she enjoyed with Buffett, according to court documents. Jane objected not only to the sum but also to the accountant’s management of the estate, his fees ($1.7 million in 2024), and his dismissive attitude towards her needs.

Rick sued in Florida to oust Jane as co-trustee, aiming to steer the trust solo. Jane fired back with a lawsuit in California, seeking to have Rick tossed from his role. Whatever the outcome, with four sets of lawyers on two coasts, this legal brawl is costly and time-consuming.

Buffett’s battle with Merkel cell carcinoma is a stark reminder of life’s unpredictability. This rare cancer strikes mostly older adults and can metastasize quickly.

Buffett tweaked his estate plan just weeks before his death, suggesting he was in a race against time. Illness can cloud judgment. Hasty decisions can leave loose ends. So how can fights like this one be avoided?

First, pick the right crew for the voyage. Buffett paired Rick and Jane, assuming their shared history with him would ensure harmony. A grieving widow and a number-crunching accountant? That’s like pairing a ukulele with a tuba. When choosing co-trustees, consider their ability to collaborate under pressure.

Secondly, Buffett’s trust lacked a mechanism to resolve co-trustee conflicts. A well-crafted plan could include a clause that would allow a trustee to be replaced if the music sours. If that had been the case, Jane could’ve fired Rick and chosen one of their adult children or a neutral corporate trustee.

Pick a trustee with experience in trusts. Rick presumably was an excellent manager for Buffett because their partnership lasted decades. But managing a nine-figure estate is a different gig. Experienced fiduciaries and advisors bring expertise in navigating complex trusts, avoiding the mistakes that can spark lawsuits.

Check the boat’s rigging before the storm. Buffett’s cancer likely was progressing swiftly at the end, but amending a trust weeks before death can be problematic. Regular reviews are preferable, that is, every few years or after major life events. Attention like this will keep a plan in tune with changing circumstances and goals.

Buffett’s music was a lesson in finding joy despite a blown-out flip-flop, but the legal troubles surrounding his estate prove that even legends can stumble. These lawsuits will grind through the public legal system for years, tainting the legacy of carefree fun left to us by the troubadour of the tropics.